Top AI tools for investment analysis

-

Bedrock AI AI for institutional investors

Bedrock AI AI for institutional investorsBedrock AI is an AI platform designed for institutional investors to enhance investment decisions by extracting, analyzing, and tabulating market insights from various data sources.

- Free Trial

-

Porfoli Smarter investing, together.

Porfoli Smarter investing, together.Porfoli is an open-source portfolio tracking platform designed to help users manage investments, collaborate, and discover high-performing portfolios in real time.

- Free

-

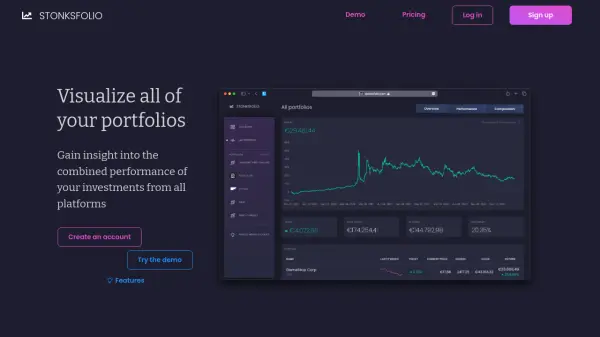

Stonksfolio Unified Investment Portfolio Visualization and Management

Stonksfolio Unified Investment Portfolio Visualization and ManagementStonksfolio enables users to visualize and monitor the combined performance of all investment portfolios across multiple platforms, providing advanced insights and rebalancing tools.

- Freemium

- From 6$

-

Splore AI-driven Insights for Streamlined Fund Management

Splore AI-driven Insights for Streamlined Fund ManagementSplore leverages AI to centralize data, automate extraction, and accelerate decision-making for alternative asset managers, enhancing productivity and operational efficiency.

- Contact for Pricing

-

Complete Intelligence Stop Guessing. Start Planning. Succeed.

Complete Intelligence Stop Guessing. Start Planning. Succeed.Complete Intelligence offers a suite of AI-driven forecasting tools like CI Markets, BudgetFlow™, CostFlow™, and AuditFlow™ to streamline financial planning, risk management, and data validation for businesses and financial managers.

- Freemium

- From 10$

-

Quartr Make better investment decisions faster.

Quartr Make better investment decisions faster.Quartr is an AI-powered financial research platform offering access to live earnings calls, real-time transcripts, company documents, and AI research tools for investors and financial professionals.

- Contact for Pricing

-

Metafide AI-Powered Trading Tools and Web3 Asset Management

Metafide AI-Powered Trading Tools and Web3 Asset ManagementMetafide provides an AI-driven suite for cryptocurrency trading, offering asset ratings, risk mitigation, and automated strategies for Web3 investors.

- Free Trial

-

DealCheck Analyze any investment property in seconds.

DealCheck Analyze any investment property in seconds.DealCheck is a real estate analysis software designed for investors, agents, and homeowners to evaluate investment properties quickly, providing financial projections and market comparisons.

- Freemium

- From 10$

-

Spike Empower your property investment

Spike Empower your property investmentSpike offers a suite of tools and insights for property investors, featuring property search, investment calculators, valuation estimates, market data, and an AI property expert named Alex.

- Free

-

Startup Falcon An AI-powered valuation tool that bridges the gap between founders and investors.

Startup Falcon An AI-powered valuation tool that bridges the gap between founders and investors.Startup Falcon is an AI-powered valuation tool designed to help entrepreneurs and investors determine a startup's worth using globally recognized qualitative methods.

- Freemium

-

DocDelta SEC Filings Analysis Powered by AI

DocDelta SEC Filings Analysis Powered by AIDocDelta utilizes AI to analyze SEC filings, transforming complex financial documents into actionable insights for investment professionals to track companies, detect risks, and monitor market movements.

- Freemium

- From 29$

-

TEXpert AI Measure, Track, and Report Social Sustainability Data for Business & Investments

TEXpert AI Measure, Track, and Report Social Sustainability Data for Business & InvestmentsTEXpert AI is a platform using AI to help companies and asset managers measure, track, and report social sustainability factors (ESG) within their workforce, supply chain, and investments.

- Contact for Pricing

-

Pebble Finance Turn Investment Complexity into Clarity with AI-Powered Portfolio Insights

Pebble Finance Turn Investment Complexity into Clarity with AI-Powered Portfolio InsightsPebble Finance provides AI-driven tools for the financial services industry, transforming news and market data into actionable portfolio insights in real-time.

- Contact for Pricing

-

ETF Insider Precision asset allocation

ETF Insider Precision asset allocationETF Insider is a data-driven portfolio analytics and optimization platform using advanced visualization to analyze ETF and mutual fund underlying holdings, identify overlaps, and manage risk.

- Freemium

- From 14$

-

Cresa Screen Deals 10x Faster with Cresa, Your CRE AI Screening Analyst

Cresa Screen Deals 10x Faster with Cresa, Your CRE AI Screening AnalystCresa is an AI-powered analyst for commercial real estate (CRE) that automates deal screening, document analysis, and report generation, helping investment teams operate more efficiently.

- Free Trial

-

StartupFuel AI-Driven Due Diligence Software & Services for Venture Capital

StartupFuel AI-Driven Due Diligence Software & Services for Venture CapitalStartupFuel provides AI-powered due diligence software and services, including DiligenceGPT, to help investors, accelerators, and family offices streamline startup evaluation and make informed decisions.

- Contact for Pricing

-

Sirius Investors AI-Powered Investment Analysis & Automation Platform

Sirius Investors AI-Powered Investment Analysis & Automation PlatformSirius Investors is an AI-powered investment analysis platform that provides real-time analysis and research for over 70,000 stocks, 4,700 cryptocurrencies, and 11,000 ETFs, helping investors make data-driven investment decisions.

- Freemium

- From 11$

-

Koble Re-engineering startup investing with AI

Koble Re-engineering startup investing with AIKoble utilizes AI and proprietary algorithms to analyze vast public data, identifying promising early-stage startup investments and aiming to outperform the market.

- Free Trial

- From 495$

-

Lorna Invest Smarter With Data-Driven Insights

Lorna Invest Smarter With Data-Driven InsightsLorna provides AI-driven investment analysis using its proprietary Cash Flow Momentum Score (CFMS) system to evaluate companies based on financial strength and cash flow performance.

- Contact for Pricing

-

Vela Partners Leading quant VC: Turning art into science through AI

Vela Partners Leading quant VC: Turning art into science through AIVela Partners is a San Francisco-based quantitative venture capital firm specializing in early-stage AI startups, utilizing AI to enhance investment strategies and support entrepreneurs globally.

- Other

-

Mission Grey Your savvy AI teammate for thriving in the global political and business environment

Mission Grey Your savvy AI teammate for thriving in the global political and business environmentMission Grey provides AI teammates for geopolitical risk management, offering tailored insights and reports for businesses, consultants, and investment managers navigating the global landscape.

- Contact for Pricing

-

Traderstats The AI-powered trading tool that helps you track, analyze, and improve your trading performance.

Traderstats The AI-powered trading tool that helps you track, analyze, and improve your trading performance.Traderstats is an AI-powered platform designed for traders to track, analyze, and enhance their trading performance through journaling, metric analysis, and AI feedback.

- Free Trial

- From 19$

-

Weave.AI Agentic AI-Powered Decision Management

Weave.AI Agentic AI-Powered Decision ManagementWeave.AI is an agentic, GenAI-powered SaaS platform designed for automating risk management, compliance, and due diligence processes across various organizational levels.

- Contact for Pricing

-

Nuvos Valuations and Deal Management: Reimagined

Nuvos Valuations and Deal Management: ReimaginedNuvos offers an AI-powered platform for commercial real estate (CRE) professionals to streamline valuations and deal management, enabling faster and smarter deal closures.

- Contact for Pricing

-

Hudson Labs AI for institutional investors

Hudson Labs AI for institutional investorsHudson Labs provides an AI platform for institutional investors, designed to extract, analyze, and tabulate market insights swiftly, supporting better investment decisions and risk assessment.

- Free Trial

-

ChatterHug Your AI Agent working to help you identify and research stocks.

ChatterHug Your AI Agent working to help you identify and research stocks.ChatterHug is an AI agent designed for stock research, providing automated weekly insights and custom research capabilities based on user-defined criteria.

- Paid

- From 24$

-

Daloopa AI Financial Modeling Copilot for Faster, More Informed Decisions

Daloopa AI Financial Modeling Copilot for Faster, More Informed DecisionsDaloopa automates financial data updates, helping analysts build and maintain financial models efficiently. It provides comprehensive, auditable data with direct links to source documents.

- Freemium

-

LocaleScan Empowering Real Estate Location Decisions

LocaleScan Empowering Real Estate Location DecisionsLocaleScan provides a detailed overview of areas surrounding real estate properties, utilizing AI to assess risks and benefits for informed decision-making.

- Free

-

S32 Your Own Property Research Assistant

S32 Your Own Property Research AssistantS32 is an AI-powered property research assistant that helps users analyze Section 32 documents, research suburbs, and understand property risks in Australia.

- Paid

- From 5$

-

SimplifiedETF Easy ETF Investing for Beginners

SimplifiedETF Easy ETF Investing for BeginnersA personalized AI-powered investment platform that helps beginners understand and invest in ETFs by providing customized investment strategies and educational resources.

- Pay Once

- From 10$

-

HouseCanary AI-powered residential real estate data and analytics platform

HouseCanary AI-powered residential real estate data and analytics platformHouseCanary is an AI-driven real estate platform providing comprehensive property data, valuations, and analytics for 136M+ properties, helping professionals make smarter real estate decisions.

- Paid

- From 19$

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.

Didn't find tool you were looking for?