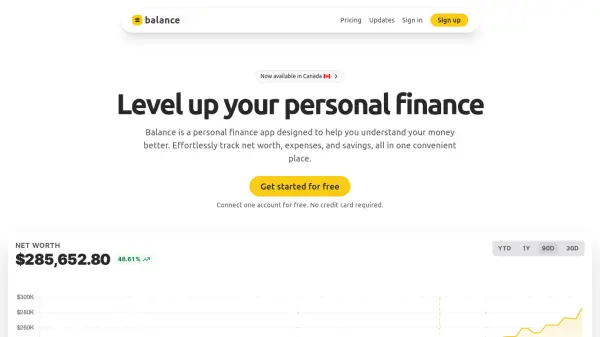

What is balance.day?

Balance is a comprehensive personal finance application that consolidates all your accounts—including checking, savings, credit cards, loans, and investments—into one secure dashboard. Users benefit from automatic transaction syncing and intelligent categorization, eliminating manual data entry while ensuring up-to-date financial insights. With access to over 12,000 institutions through secure connections, Balance empowers individuals to seamlessly track net worth, expenses, and savings with ease.

Utilizing automated insights and customizable filters, Balance enables users to visualize trends, detect payments and transfers, and set custom alerts for low balances. Interactive charts, granular search, and daily digests equip users with the tools needed for enhanced financial decision-making. Robust security features ensure data is protected, making Balance a trustworthy solution for those seeking clarity and control over their finances.

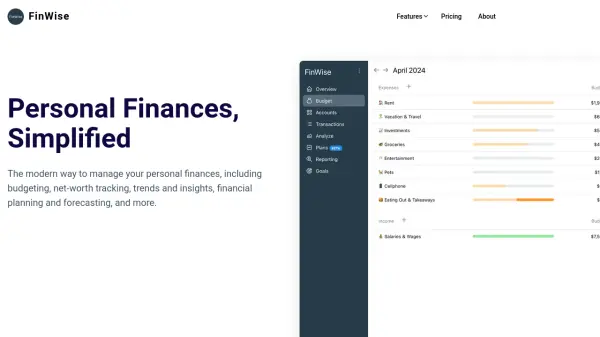

Features

- Automatic Account Sync: Seamlessly connect to over 12,000 financial institutions with secure data fetching.

- Comprehensive Financial Dashboard: Monitor checking, savings, credit cards, loans, and investments in one place.

- Intelligent Categorization: Automated transaction tagging and categorization for easy organization.

- Interactive Visualizations: Detailed charts and graphs to reveal spending patterns and trends.

- Custom Alerts: Receive low balance and transaction alerts to avoid overdrafts and unwanted charges.

- Granular Filtering and Search: Advanced filters and universal search options to quickly find transactions.

- Daily Financial Digests: Receive daily email summaries of financial activity for timely oversight.

- Payments & Transfers Detection: Automatic recognition of intra-account payments and transfers to ensure accurate reporting.

- Custom Views: Save personalized filters and views for repeated analysis.

- Security by Default: Encryption, secure connections, and robust authentication methods to protect user data.

Use Cases

- Consolidate all your financial accounts for holistic money management.

- Monitor spending across categories and adjust budgets accordingly.

- Track net worth and savings over time to achieve financial goals.

- Detect errors, fraud, or unwanted subscription charges early.

- Access interactive reports for detailed analysis of past spending and income trends.

- Set and monitor low balance alerts to prevent overdraft fees.

- Automate expense tracking to save time and reduce manual spreadsheet management.

FAQs

-

Which countries is Balance available in?

Balance is currently available in the United States and Canada. -

Do you support multiple currencies?

Balance does not currently support multiple currencies. -

Do you support crypto wallets?

Crypto wallet support is not available yet. -

Do I need to share my bank credentials?

No, Balance uses Plaid for secure connections, and users should never share their bank credentials directly. -

What is your cancellation policy?

Users can cancel within the first 30 days of subscribing and receive a full refund.

Related Queries

Helpful for people in the following professions

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.