What is Compound Interest Calculator?

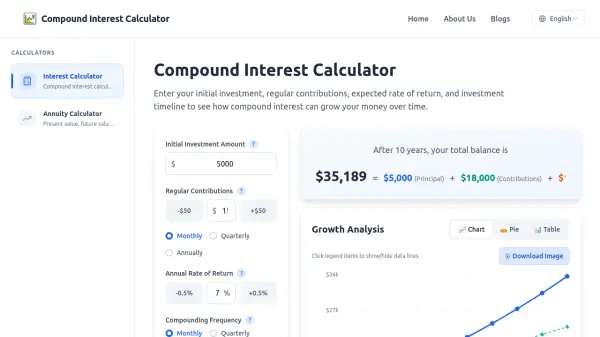

Compound Interest Calculator empowers users to model their investment growth by leveraging the science of compounding. By inputting the initial investment, ongoing contributions, expected rate of return, compounding frequency, and investment duration, individuals can see how their money accumulates over time. The platform is user-friendly, providing versatile input options for contribution schedules and rates, and includes features like inflation adjustment for realistic forecasting.

The tool also offers educational content on topics such as the importance of compound interest, optimization strategies, and wealth-building principles. This makes it suitable not only for hands-on calculations but also for learning how to maximize long-term savings and financial planning strategies. The clear, step-by-step interface makes complex financial concepts accessible to everyone planning for their financial future.

Features

- Customizable Inputs: Adjust initial investment, regular contributions, rate of return, compounding frequency, and duration.

- Inflation Adjustment: Option to factor in inflation for real-world projections.

- Multiple Compounding Options: Choose monthly, quarterly, or annual compounding periods.

- Instant Results: Immediate calculation of projected wealth accumulation.

- Financial Education: Includes guides on maximizing returns, compound interest, and investment concepts.

Use Cases

- Planning for retirement with realistic investment projections.

- Comparing impact of different investment strategies over long periods.

- Simulating the effects of changing contribution amounts and schedules.

- Understanding the difference in outcomes based on compounding frequency.

- Teaching students or clients the benefits of compound interest.

FAQs

-

What is compound interest and how does it work in investments?

Compound interest allows both the initial investment and previously earned interest to generate new earnings, resulting in exponential growth over time. -

How accurate are the compound interest calculations in this calculator?

The calculator provides estimates based on user inputs and standard financial formulas; actual investment results may vary due to market conditions. -

What's the difference between different compounding frequencies in compound interest?

A higher compounding frequency (e.g., monthly vs. annually) generally increases the total returns on your investment due to more frequent addition of interest. -

Should I contribute at the beginning or end of each period for maximum compound interest?

Contributing at the beginning of each period allows your money to start earning interest sooner, leading to greater compounding benefits. -

Can I use this compound interest calculator for retirement planning?

Yes, the calculator is suitable for retirement planning and helps estimate how regular investments can accumulate over time.

Related Queries

Helpful for people in the following professions

Compound Interest Calculator Uptime Monitor

Average Uptime

100%

Average Response Time

2039.93 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.