What is Louisiana Mortgage Calculator?

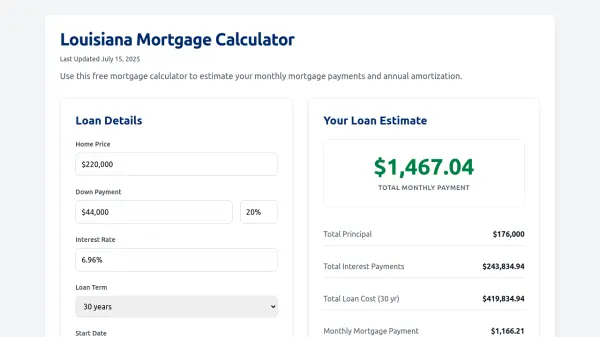

Louisiana Mortgage Calculator offers a free, user-friendly online service enabling users to estimate their monthly mortgage payments and annual amortization for Louisiana home purchases. Users can input key details such as home price, down payment, loan term, interest rate, property taxes, homeowners insurance, and HOA fees to generate a comprehensive loan estimate tailored to their financial scenario.

The calculator automatically provides detailed breakdowns including total monthly payment, principal, interest, overall loan cost over the selected term, and the expected payoff date. Additional educational content helps users understand mortgage terminology and factors influencing costs, making it a valuable resource for informed homebuying decisions in Louisiana. All calculations are estimates and intended to guide users toward understanding and managing mortgage obligations.

Features

- Comprehensive Calculation: Estimates monthly payments, total loan cost, and amortization schedule.

- Adjustable Inputs: Allows customization for home price, down payment, interest rate, loan term, property taxes, insurance, and HOA fees.

- Detailed Loan Breakdown: Displays principal, interest payments, total cost, and payoff date.

- Educational Guidance: Explains key mortgage concepts, loan types, and payment structures.

- Updated Rate Information: Provides current mortgage and APR rates for multiple loan types.

- Local Relevance: Tailored for Louisiana residents with area-specific information.

Use Cases

- Estimating monthly mortgage payments before purchasing a home in Louisiana.

- Comparing different loan terms and interest rates to choose the most cost-effective mortgage.

- Planning a household budget with full knowledge of mortgage and related property costs.

- Educating first-time homebuyers about the breakdown of mortgage payments.

- Assessing the impact of down payments, insurance, and property taxes on total loan cost.

FAQs

-

What factors influence my mortgage payment in Louisiana?

Your mortgage payment is influenced by the home price, down payment, interest rate, loan term, property taxes, homeowners insurance, and any applicable HOA fees. -

Is it necessary to have a 20% down payment to buy a home?

While a 20% down payment helps you avoid private mortgage insurance, many loan programs allow for lower down payments, with FHA loans starting as low as 3.5%. -

How does my credit score affect my mortgage rate?

A higher credit score can qualify you for lower interest rates and better loan terms, while lower scores may result in higher rates and limited loan options. -

What is the difference between fixed-rate and adjustable-rate mortgages?

Fixed-rate mortgages maintain the same interest rate and payments for the entire term, while adjustable-rate mortgages may start with lower rates that adjust periodically based on market conditions. -

How accurate are the mortgage calculator estimates?

The calculator provides estimates based on user input and general market data; actual loan offers and payments may vary depending on your qualifications and lender terms.

Helpful for people in the following professions

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.