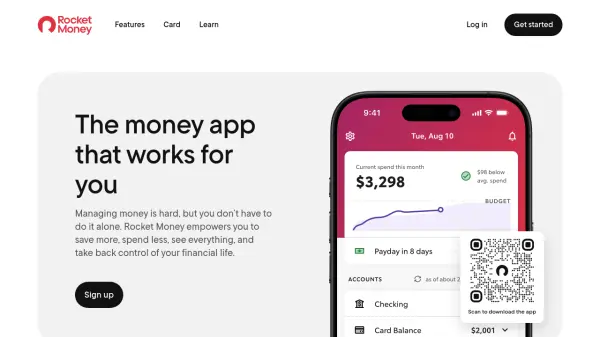

What is Rocket Money?

A sophisticated financial management platform that combines automated technology with human expertise to help users take control of their finances. The service has helped over 5 million members save more than $1 billion through bill negotiations, subscription management, and smart savings features.

The platform offers comprehensive financial tracking capabilities, including subscription monitoring, spending analysis, and automated savings tools. With both free and premium tiers, users can access features ranging from basic account linking to personalized bill negotiation services and expert financial assistance.

Features

- Account Integration: Link checking, savings, credit cards, and investment accounts

- Smart Subscription Management: Automatically identifies and tracks recurring bills

- Automated Savings: AI-powered system that saves money based on spending habits

- Bill Negotiation: Human experts negotiate better rates on existing bills

- Credit Score Monitoring: Track credit score and receive important alerts

- Budgeting Tools: Automated spending tracking and categorization

- Net Worth Tracking: Comprehensive view of assets and debts

- Expert Support: Access to financial experts for personalized assistance

Use Cases

- Managing and canceling unwanted subscriptions

- Tracking daily expenses and creating budgets

- Automating savings goals

- Negotiating lower bills

- Monitoring credit score changes

- Analyzing spending patterns

- Managing shared household finances

- Building long-term wealth tracking

FAQs

-

How much money can I save using Rocket Money?

According to user testimonials, savings can vary significantly. Some users report saving over $200 in the first week alone through subscription cancellations and bill negotiations. -

Is my financial data secure with Rocket Money?

Yes, Rocket Money uses bank-level security measures and partners with FDIC member banks to ensure your financial data is protected. -

Can I share my account with family members?

Yes, Premium users can access shared accounts to manage household budgets and subscriptions together. -

What's the difference between free and premium features?

The free version includes basic account linking, balance alerts, subscription tracking, and spend tracking. Premium adds features like subscription cancellation assistance, expert chat support, unlimited budgets, and net worth tracking.

Related Queries

Helpful for people in the following professions

Rocket Money Uptime Monitor

Average Uptime

100%

Average Response Time

141.6 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.