What is Taxly.ai?

Taxly.ai is an innovative AI-powered tax management platform designed specifically for Australian self-employed professionals, freelancers, and sole traders. The platform seamlessly connects with users' bank accounts to automatically identify and categorize eligible tax deductions, streamlining the entire tax filing process.

The system combines advanced AI technology with expert CPA support, offering real-time transaction scanning, automated deduction identification, and personalized tax recommendations. With a reported 98% improvement in tax deduction efficiency, Taxly.ai eliminates the need for complicated spreadsheets while ensuring accurate tax reporting and maximum savings.

Features

- AI Deduction Scanner: Automatically identifies eligible tax deductions from bank transactions

- CPA Expert Support: 24/7 access to certified Australian tax professionals

- Real-time Tracking: Continuous monitoring and categorization of expenses

- Quarterly Tax Calculator: AI-powered estimation of quarterly tax payments

- Software Integration: API connectivity with accounting platforms

- Secure Data Management: Enhanced encryption and privacy measures

- Mobile Accessibility: Tax management on the go

- Automated Reporting: Personalized tax reports and recommendations

Use Cases

- Freelance tax deduction management

- Quarterly tax payment planning

- Business expense tracking

- Tax compliance documentation

- Financial record keeping

- Tax savings optimization

- Multiple income stream management

FAQs

-

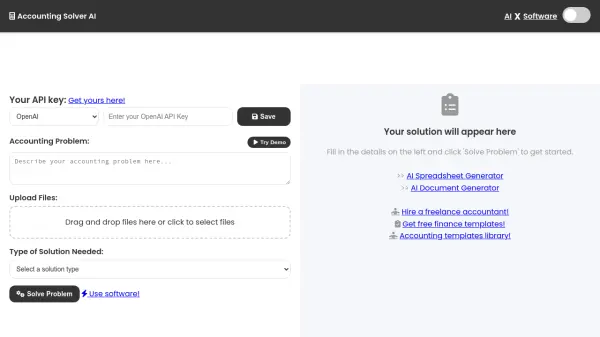

How does the AI technology improve tax filing efficiency?

The AI technology improves efficiency by automatically scanning transactions, identifying eligible deductions, and categorizing expenses, resulting in 98% more savings and eliminating manual paperwork. -

What kind of support is available for users?

Users have access to 24/7 expert CPA support from Australian tax professionals who can provide personalized advice and review tax information. -

How does the integration process work?

Users can connect their bank accounts and ATO tax transaction accounts, and the system automatically begins scanning and categorizing transactions for tax purposes.

Related Queries

Helpful for people in the following professions

Taxly.ai Uptime Monitor

Average Uptime

94.82%

Average Response Time

126.3 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.