What is Synapse Analytics?

Synapse Analytics provides an all-in-one AI credit decisioning platform aimed at transforming the lending process for financial institutions. By leveraging artificial intelligence, the platform helps organizations accelerate credit approvals, enhance customer onboarding, and reduce overall risk associated with lending. It facilitates confident credit decisions through improved accuracy and consistency, enabling businesses to grow their loan portfolios responsibly.

The platform focuses on streamlining lending workflows by eliminating bottlenecks and empowering teams to focus on high-value tasks. Synapse Analytics utilizes alternative data-driven insights to help businesses expand into new markets, particularly targeting high-growth, unbanked segments. It offers tailored solutions for various industries including Fintechs, Retail Banks, Telecoms, and SME Lenders, supporting faster go-to-market strategies for new credit programs without heavy reliance on technical teams.

Features

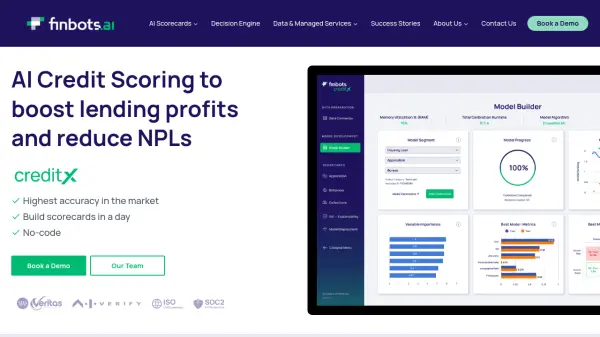

- AI Credit Scoring: Utilizes artificial intelligence for accurate credit assessment.

- ID Verification: Streamlines client onboarding by verifying personal documents.

- Liveness Detection: Adds protection against stolen IDs and impersonation during onboarding.

- Fraud Detection: Quickly identifies abnormalities in verification documents to flag fraudulent applicants.

- Document Processing: Processes various document types like IDs, licenses, passports, and bank statements rapidly.

- No-Code Workflows: Enables building custom credit policies without coding.

- Auto-ML: Allows configuration and deployment of personalized AI credit decisioning models.

- Simulation Reports: Facilitates testing different credit workflows to select the optimal policy.

- Risk Appetite Control: Permits setting custom risk thresholds and lending criteria.

- Machine Learning Ops: Simplifies retraining models, monitoring performance, and maintaining standards.

- Alternative Data Insights: Leverages alternative data to assess creditworthiness, especially for unbanked populations.

Use Cases

- Accelerate customer and business onboarding processes.

- Implement Buy Now Pay Later (BNPL) programs.

- Optimize product cross-selling strategies.

- Develop a unified credit scoring system.

- Improve credit underwriting accuracy and speed.

- Reduce non-performing loans through better risk assessment.

- Streamline overall lending workflows and operations.

- Expand lending reach to unbanked and underbanked markets.

FAQs

-

What industries does Synapse Analytics cater to?

Synapse Analytics provides tailored solutions for Fintechs, Retail Banks, Telecoms, and SME Lenders. -

How does Synapse Analytics help reduce risk?

It enables more confident and accurate credit decisions through AI-powered analysis and alternative data insights, helping institutions grow their portfolios responsibly and reduce non-performing loans. -

Can Synapse Analytics integrate with existing systems?

Yes, the platform offers seamless integration capabilities to fit within your existing tech stack, whether it's cloud-based or on-premise. -

How does Synapse Analytics help reach new markets?

It utilizes alternative data-driven insights and dynamic scoring policies to assess individuals often overlooked by traditional scoring, thereby opening doors to high-growth, unbanked, and underbanked markets. -

Does Synapse Analytics require coding to build credit policies?

No, it features no-code workflows allowing users to build and implement credit policies in minutes without needing IT or technical team assistance.

Related Queries

Helpful for people in the following professions

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.