Synapse Analytics - Alternatives & Competitors

Revolutionize Credit Decisioning with AI-Powered Precision.

Synapse Analytics is an AI credit decisioning platform designed to increase loan approvals, reduce risk, and streamline operations for financial institutions.

Ranked by Relevance

-

1

finbots.ai AI Credit Scoring to Boost Lending Profits and Reduce NPLs

finbots.ai AI Credit Scoring to Boost Lending Profits and Reduce NPLsfinbots.ai offers creditX, an AI-powered credit scoring solution that helps lenders increase approvals, reduce risk, and improve efficiency.

- Contact for Pricing

-

2

KYC Hub AI-based Risk Detection and Automation for AML and Fraud

KYC Hub AI-based Risk Detection and Automation for AML and FraudKYC Hub offers an AI-powered platform for comprehensive risk management, AML compliance, and fraud prevention. It provides workflow automation, global screening, and real-time monitoring to streamline compliance processes.

- Contact for Pricing

-

3

Pagaya AI-powered credit analysis for smarter lending decisions

Pagaya AI-powered credit analysis for smarter lending decisionsPagaya is an AI-powered financial technology platform that helps lending institutions analyze credit applications and make better lending decisions without increasing risk.

- Contact for Pricing

-

4

ADEPT Decisions Platform The Fintech Lending Toolkit for Optimized Credit Decisions

ADEPT Decisions Platform The Fintech Lending Toolkit for Optimized Credit DecisionsThe ADEPT Decisions Platform is a no-code, cloud-native decision engine leveraging Machine Learning to automate and optimize lending decisions for financial institutions.

- Contact for Pricing

-

5

Inscribe State-of-the-art AI Risk Agents for automated financial risk management

Inscribe State-of-the-art AI Risk Agents for automated financial risk managementInscribe offers AI-powered risk management solutions for financial institutions, featuring AI Risk Agents and Models that automate complex onboarding and underwriting workflows while reducing fraud risks.

- Contact for Pricing

-

6

cred.ai Bank-tech for a Better Financial Life

cred.ai Bank-tech for a Better Financial Lifecred.ai provides advanced banking infrastructure and financial technology designed for security, premium experience, and well-being. It offers solutions for consumers and custom programs for large brands.

- Other

-

7

Zest AI Proven AI for a Thriving Lending Ecosystem

Zest AI Proven AI for a Thriving Lending EcosystemZest AI provides AI-powered solutions for lenders, improving underwriting accuracy, automating decisions, and reducing risk. The platform helps financial institutions make smarter, fairer, and faster lending decisions.

- Contact for Pricing

-

8

FinBraine Next-Gen Lending Management and KYC Software

FinBraine Next-Gen Lending Management and KYC SoftwareFinBraine provides AI-powered lending management and digital KYC software solutions for Telecom, Retail, Banking, and eCommerce sectors.

- Contact for Pricing

-

9

Sift Better Fraud Decisions Through Identity Trust

Sift Better Fraud Decisions Through Identity TrustSift is an AI-powered risk decisioning platform that helps businesses secure the customer journey and create revenue from risk. It provides comprehensive fraud prevention solutions for various industries.

- Contact for Pricing

-

10

Arya AI Production-Ready AI for Finance

Arya AI Production-Ready AI for FinanceArya AI provides pre-built, finance-specific AI models and APIs to help banks, insurance companies, and financial institutions streamline operations, enhance security, and improve decision-making.

- Contact for Pricing

-

11

ComplyAdvantage AI-Powered AML and Fraud Risk Detection Platform

ComplyAdvantage AI-Powered AML and Fraud Risk Detection PlatformComplyAdvantage is an AI-driven platform that delivers advanced anti-money laundering (AML) and fraud risk detection solutions for financial institutions and regulated businesses worldwide.

- Contact for Pricing

-

12

Credolab Data & Analytics Platform for Lower Credit Risk, Fraud Detection, and Improved Marketing

Credolab Data & Analytics Platform for Lower Credit Risk, Fraud Detection, and Improved MarketingCredolab is a data and analytics platform leveraging first-party metadata and AI to provide predictive scores and insights, helping businesses reduce credit risk, combat fraud, and optimize marketing efforts.

- Paid

- From 600$

-

13

Digitap Advanced AI and ML SAAS Solutions for Financial Institutions

Digitap Advanced AI and ML SAAS Solutions for Financial InstitutionsDigitap provides AI-powered SAAS solutions for BFSI, Fintech, and Financial Institutions, offering automated risk management, customer onboarding, and data enrichment services.

- Contact for Pricing

-

14

LexisNexis Risk Solutions Transforming Risk Decision Making with Data and Analytics

LexisNexis Risk Solutions Transforming Risk Decision Making with Data and AnalyticsLexisNexis Risk Solutions provides data and technology services that empower businesses and government entities to manage risk, improve outcomes, and make informed decisions.

- Contact for Pricing

-

15

Synna Automate Data Gathering and Reporting with AI-Powered Web Scraping

Synna Automate Data Gathering and Reporting with AI-Powered Web ScrapingSynna is a no-code platform that combines AI and web scraping to automate data gathering, analysis, and reporting tasks. It offers secure, automated data collection solutions for businesses with built-in encryption and privacy features.

- Contact for Pricing

-

16

AnalysAI Say Goodbye To Boring Spreadsheets

AnalysAI Say Goodbye To Boring SpreadsheetsAnalysAI is a user-friendly, AI-powered data analysis software that integrates multiple data sources to provide deep insights and predictive analytics for businesses.

- Freemium

- From 29$

-

17

Smart Solution Accelerate Financial Evolution Through Core Banking Innovation

Smart Solution Accelerate Financial Evolution Through Core Banking InnovationSmart Solution delivers advanced banking infrastructure, empowering financial institutions with scalable, technology-focused platforms for growth, compliance, and exceptional customer service.

- Contact for Pricing

-

18

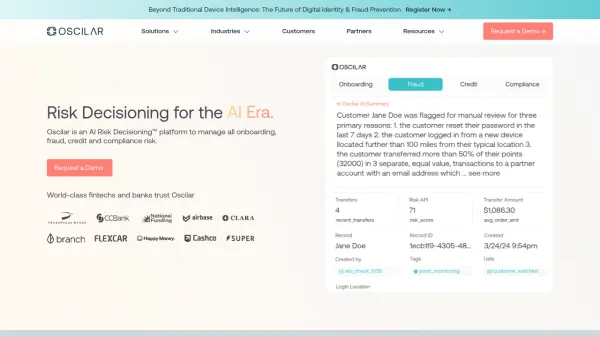

Oscilar Risk Decisioning for the AI Era

Oscilar Risk Decisioning for the AI EraOscilar is an AI Risk Decisioning™ platform designed to manage onboarding, fraud, credit, and compliance risks for financial institutions.

- Contact for Pricing

-

19

Onnix Personalized AI Co-Pilot for Bankers

Onnix Personalized AI Co-Pilot for BankersOnnix is an AI-powered platform designed to enhance the productivity of banking teams by automating tasks and providing quick, accurate data analysis and content generation.

- Contact for Pricing

-

20

Addy AI Close mortgage loans in days, not weeks

Addy AI Close mortgage loans in days, not weeksAddy AI is an advanced mortgage lending platform that uses custom AI models to automate manual tasks in the mortgage process, helping lenders close loans faster and increase profitability.

- Contact for Pricing

-

21

Entobase AI-Powered Lending Solutions

Entobase AI-Powered Lending SolutionsEntobase offers AI-powered lending solutions for individuals and businesses, connecting borrowers with over 100 lenders through a single application.

- Free

-

22

CredCore Modernize Enterprise Debt Investment & Management

CredCore Modernize Enterprise Debt Investment & ManagementCredCore is an AI-powered debt management platform designed to simplify the mobilization and monitoring of capital for funds and enterprises. It leverages domain-specific AI to automate compliance, track portfolios, and manage risks.

- Contact for Pricing

-

23

Surfsite Empowering Organizations with AI Agents

Surfsite Empowering Organizations with AI AgentsSurfsite provides AI-powered assistants grounded in your company's data, enabling more accurate decisions and efficient workflows. Securely integrate your tools and leverage AI for streamlined operations.

- Contact for Pricing

-

24

SmartDispute.ai Repair your own credit using the power of artificial intelligence

SmartDispute.ai Repair your own credit using the power of artificial intelligenceSmartDispute.ai is an AI-powered credit repair system that helps users identify and remove negative accounts affecting their credit score through automated dispute generation and tracking across all three credit bureaus.

- Paid

- From 49$

-

25

AI Insurance The Insurance Platform for New Programs and Captives

AI Insurance The Insurance Platform for New Programs and CaptivesAI Insurance is a comprehensive insurance management platform designed for new programs and captives. It offers AI-powered automation for claims management, financials, and more.

- Free

-

26

Senso AI-Powered Agents For Financial Services

Senso AI-Powered Agents For Financial ServicesSenso provides AI agents designed to improve operational efficiency and staff productivity for financial institutions. Transform unstructured policies into structured knowledge for streamlined operations.

- Contact for Pricing

-

27

Plaid Connect, verify, and enrich financial data securely in real time

Plaid Connect, verify, and enrich financial data securely in real timePlaid provides secure, real-time connectivity to financial data, streamlining onboarding, payments, risk assessment, and personal finance management for businesses and developers.

- Usage Based

-

28

Quantexa The platform to automate and augment your decision-making with AI

Quantexa The platform to automate and augment your decision-making with AIQuantexa is a Decision Intelligence Platform that uses AI to unify data, provide context, and enable better decision-making across organizations for financial crime prevention, customer intelligence, and risk management.

- Contact for Pricing

-

29

Ntropy Insights Save 80% on underwriting a business using AI and bank data.

Ntropy Insights Save 80% on underwriting a business using AI and bank data.Ntropy Insights utilizes AI with bank data to automatically generate Profit & Loss (P&L) and cash statements in milliseconds, significantly accelerating the business underwriting process.

- Contact for Pricing

-

30

Greenlite The Trusted AI Platform for Financial Crime

Greenlite The Trusted AI Platform for Financial CrimeGreenlite is an AI-powered platform that automates financial compliance workflows, helping financial institutions streamline screening alerts, transaction monitoring, and customer due diligence processes with enhanced efficiency.

- Contact for Pricing

-

31

Synchronymax Boost Productivity with AI Workforce

Synchronymax Boost Productivity with AI WorkforceSynchronymax offers an AI Agent Platform to augment your knowledge workforce, enhancing efficiency, performance, and growth through specialized AI agents.

- Paid

-

32

Deduce AI-Driven Real-Time Identity Fraud Detection

Deduce AI-Driven Real-Time Identity Fraud DetectionDeduce uses advanced AI and patented identity graph technology to detect and prevent stolen and synthetic identities in real time, protecting organizations from identity fraud losses.

- Contact for Pricing

-

33

Synapse Medicine Make Every Prescription a Success with AI-Powered Clinical Decision Support

Synapse Medicine Make Every Prescription a Success with AI-Powered Clinical Decision SupportSynapse Medicine provides AI-driven clinical decision support components for EHRs and e-prescribing software, enhancing medication safety and streamlining workflows.

- Contact for Pricing

-

34

Farsight AI Complex AI Automations for Finance

Farsight AI Complex AI Automations for FinanceFarsight AI offers advanced AI-powered automation solutions tailored for the financial services industry, improving accuracy and efficiency in complex tasks.

- Contact for Pricing

-

35

Decisimo Cloud-based Decision Intelligence System for Business Automation

Decisimo Cloud-based Decision Intelligence System for Business AutomationDecisimo is an AI-powered cloud platform that automates business rule execution, enhances decision logic, and streamlines operations for fintech and insurtech sectors.

- Contact for Pricing

-

36

Profit Leap AI-driven financial solutions for smarter business decisions

Profit Leap AI-driven financial solutions for smarter business decisionsProfit Leap offers an AI-powered business advisor named Huxley that combines specialized business knowledge with data analysis to deliver instant insights and strategic financial recommendations for businesses of all sizes.

- Contact for Pricing

-

37

SwiftAI Enterprise AI, Simplified.

SwiftAI Enterprise AI, Simplified.SwiftAI offers an enterprise AI platform, Symphony, designed to seamlessly integrate AI-powered solutions with SAP systems, automating workflows and optimizing operations.

- Contact for Pricing

-

38

Bank Statement App AI-Powered Bank Statement Analysis for Financial Insights

Bank Statement App AI-Powered Bank Statement Analysis for Financial InsightsBank Statement App utilizes AI to analyze bank statements, providing clear financial insights and enabling users to understand spending patterns and manage finances effectively.

- Usage Based

-

39

Flowiz.AI AI Agents That Work While You Sleep

Flowiz.AI AI Agents That Work While You SleepFlowiz.AI offers a no-code platform to automate tasks and streamline workflows using AI agents. It helps businesses, particularly in insurance, improve efficiency, reduce costs, and enhance customer experience.

- Contact for Pricing

-

40

RiskSeal Smart decisions through digital footprints

RiskSeal Smart decisions through digital footprintsRiskSeal is a global platform for alternative credit risk data that provides 400+ instant data points and digital credit scoring through analysis of digital footprints across 200+ online platforms.

- Usage Based

- From 499$

-

41

GiniMachine No-Code AI Decision-Making Software

GiniMachine No-Code AI Decision-Making SoftwareGiniMachine is a no-code AI platform that builds predictive models for actionable business insights, improving decision-making and productivity.

- Free Trial

-

42

MarkovML Turn Data Chaos into Business Insights

MarkovML Turn Data Chaos into Business InsightsMarkovML is a no-code AI platform that enables business teams to build custom AI workflows, applications, and generate insights from their data without coding or IT support.

- Freemium

- From 99$

-

43

Harbr Fast-track customer onboarding with the industry's most extensible credit application software

Harbr Fast-track customer onboarding with the industry's most extensible credit application softwareHarbr is an advanced credit application software that streamlines customer onboarding by integrating with Creditsafe and banking data providers, offering automated credit decisions and comprehensive application management for businesses.

- Contact for Pricing

-

44

Vaultedge Transform documents into actionable data with Document AI suite

Vaultedge Transform documents into actionable data with Document AI suiteVaultedge provides a Document AI suite utilizing AI OCR and lending APIs to automate document recognition, data extraction, validation, and compliance checks, reducing manual work and accelerating approvals.

- Contact for Pricing

-

45

Superagent A workspace where your team and AI work together.

Superagent A workspace where your team and AI work together.Superagent is a collaborative AI platform designed to integrate with your team's workflow. It handles tasks, connects to existing services, and processes large data volumes across various project types.

- Contact for Pricing

-

46

Optalitix Futureproof your pricing

Optalitix Futureproof your pricingOptalitix provides collaborative, no-code software for actuaries, underwriters, and executives to futureproof pricing, supercharge insurance underwriting, and revolutionize lending processes.

- Contact for Pricing

-

47

Trust Swiftly Flexible & Accurate Identity Verification.

Trust Swiftly Flexible & Accurate Identity Verification.Trust Swiftly provides a customizable identity verification platform with 15+ methods, helping businesses automate trust and safety workflows while combating fraud.

- Paid

- From 49$

-

48

ScreenlyyID Trusted Global KYC Verification & Risk Management Platform

ScreenlyyID Trusted Global KYC Verification & Risk Management PlatformScreenlyyID is an advanced, automated KYC and identity verification solution designed to streamline compliance, detect fraud, and support secure onboarding for businesses worldwide.

- Freemium

- From 149$

-

49

ContextClue AI Knowledge Base to Boost Your Business

ContextClue AI Knowledge Base to Boost Your BusinessContextClue is an enterprise-level AI solution that provides intelligent data integration, text summarization, and document generation capabilities, enabling businesses to analyze and leverage their knowledge base effectively.

- Contact for Pricing

-

50

AI Credit Repair AI-powered credit repair solution for identifying and removing credit report errors

AI Credit Repair AI-powered credit repair solution for identifying and removing credit report errorsAI Credit Repair is an advanced credit management platform that uses artificial intelligence to help users monitor, repair, and protect their credit through automated dispute resolution and personalized improvement strategies.

- Pay Once

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.

Didn't find tool you were looking for?