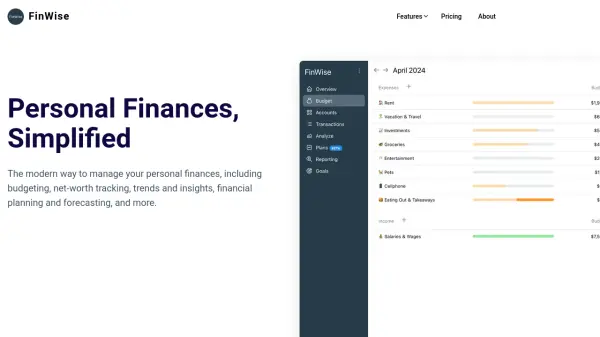

What is WalletHub?

WalletHub delivers a robust platform to help users manage and optimize their overall financial health. Leveraging advanced analytics, it offers tools for creating and tracking budgets, monitoring spending patterns, and building comprehensive debt payoff strategies. By consolidating essential financial management functions, users can track net worth, manage recurring expenses, and evaluate financial goals in a single interface.

WalletHub also features cutting-edge credit monitoring, daily updated credit scores, personalized improvement plans, and identity protection services, including dark web monitoring and identity theft insurance. Additionally, proprietary rating systems help users find the best credit cards, loans, and banking products by providing unbiased, data-driven recommendations. The platform is trusted for its editorial independence, robust security measures, and user-friendly experience.

Features

- Budgeting Tool: Create, track, and manage personal budgets easily.

- Spending Tracker: Analyze spending habits and identify savings.

- Net Worth Monitoring: Track and grow net worth over time.

- Debt Payoff Planning: Personalized plans to accelerate debt repayment.

- WalletScore: Unify financial health into a single actionable score.

- Credit Report & Score: Free daily credit score updates and analytics.

- Credit Monitoring: 24/7 real-time credit and identity monitoring.

- Credit Lock: Instantly lock/unlock TransUnion credit to prevent unauthorized use.

- Dark Web Monitoring: Daily scans for exposed personal/financial info.

- Identity Theft Insurance: Up to $1 million coverage against identity theft.

Use Cases

- Monitor and improve personal credit scores in real-time.

- Create and maintain a customized household budget.

- Track investments, net worth, and recurring expenses.

- Establish and execute a debt payoff plan tailored to user finances.

- Receive alerts for potential identity theft or fraudulent activities.

- Evaluate and discover the best financial products, such as credit cards and loans.

- Access proprietary credit card and loan recommendations unbiased by advertisers.

- Protect against unauthorized access to personal financial data.

FAQs

-

Does checking my credit score on WalletHub affect my credit?

No, checking your credit score on WalletHub does not impact your credit or trigger a hard inquiry. -

What types of identity protection does WalletHub offer?

WalletHub provides dark web monitoring, real-time identity alerts, and up to $1 million in identity theft insurance for comprehensive protection. -

Are WalletHub's credit card recommendations unbiased?

Yes, WalletHub uses a proprietary rating system and maintains full editorial independence, ensuring recommendations are objective and unbiased. -

How frequently is my credit score updated on WalletHub?

WalletHub updates your credit score daily, unlike most services that update weekly or monthly.

Related Queries

Helpful for people in the following professions

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.